A Volatile Start Of 2016

The financial markets have been extremely volatile over the past several weeks. This article seeks to pin-point why, discuss broader aspects of volatility, and gives practical solutions for risk management.

First, it would be helpful to define volatility. Volatility is when the financial markets experience a decline or a draw-down. Generally, and paradoxically, volatility is not associated with sharply rising markets. A rise in capital markets -- either a sharp rise or an extended rise -- will cause volatility to decline. Only downside price movement causes volatility to rise. Second, there are several measures of volatility (i.e., standard deviation, variance, the Sortino Ratio, etc.). One of the most common gauges of volatility is the VIX Index. The VIX Index measures implied volatility on a 30-day forward-looking basis on the S&P 500 Index, a broad market index. Typically, actual volatility will be lower than implied volatility and that is one of the reasons various ETFs and financial products tied to the VIX Index experience a negative carry over time.

Between 2010 through the end of 2014, the markets were very steady, rising steadily and bouncing back swiftly from any temporary declines. The reason for this was the various Quantitative Easing programs created by the Fed. The Fed created this stimulus in a variety of ways: (1) buying U.S. Treasury bonds, (2) buying U.S. Treasury notes, (3) buying agency MBS, and (4) lowering the Fed Funds Rate and broadcasting to the market it was going to remain low for an extended period of time. The effect was that all this monetary stimulus euthanized volatility.

Now, with the withdrawal of stimulus, that has changed. Volatility has entered the picture again because the factors that suppressed it are either no longer there (no more bond buying going on) or being withdrawn (Fed is now trying to raise the interest rate, not lower it any more). Accordingly, it is now typical to have a -230 point move down in a day in the stock market. On the one hand, this is very unpleasant for the investor community because sharp draw-downs are anathema. On the other hand, this price movement accords to a more natural price discovery for security prices without the artificial interference of central banks.

A second reason why the financial markets have become more volatile is that the path of rate hikes is unknown. There could be one or two more rate hikes in 2016. This is something the market is constantly sifting and impounding the information instantaneously.

A third reason the markets became more volatile recently was that three small community banks in Italy went under. Under the European model of dealing with a failed back, the depositors' assets (clients' money in checking and savings accounts) are seized. (No such thing as FDIC insurance in Europe.) An elderly retiree committed suicide when this happened and many human rights groups came in and demanded that there be criminal prosecutions against the management of the bank. This effort put a magnifying glass on Italian banks and fanned fears there may be a much larger Italian bank that could go under. Fear of this systemic risk jumped the Atlantic and instantly (and irrationally) affected many U.S. securities in the financials sector.

One enticing inclination to protect against risk is to go long volatility through various VIX Index products or ETFs. However, the way these instruments are constructed, there is a built-in negative carry which causes an incremental daily decline in price. Thus, the underlying VIX Index must really spike or go up a lot for the instrument to profit and overcome the negative carry costs.

A much better solution to protect against risk and volatility is through asset class diversification.

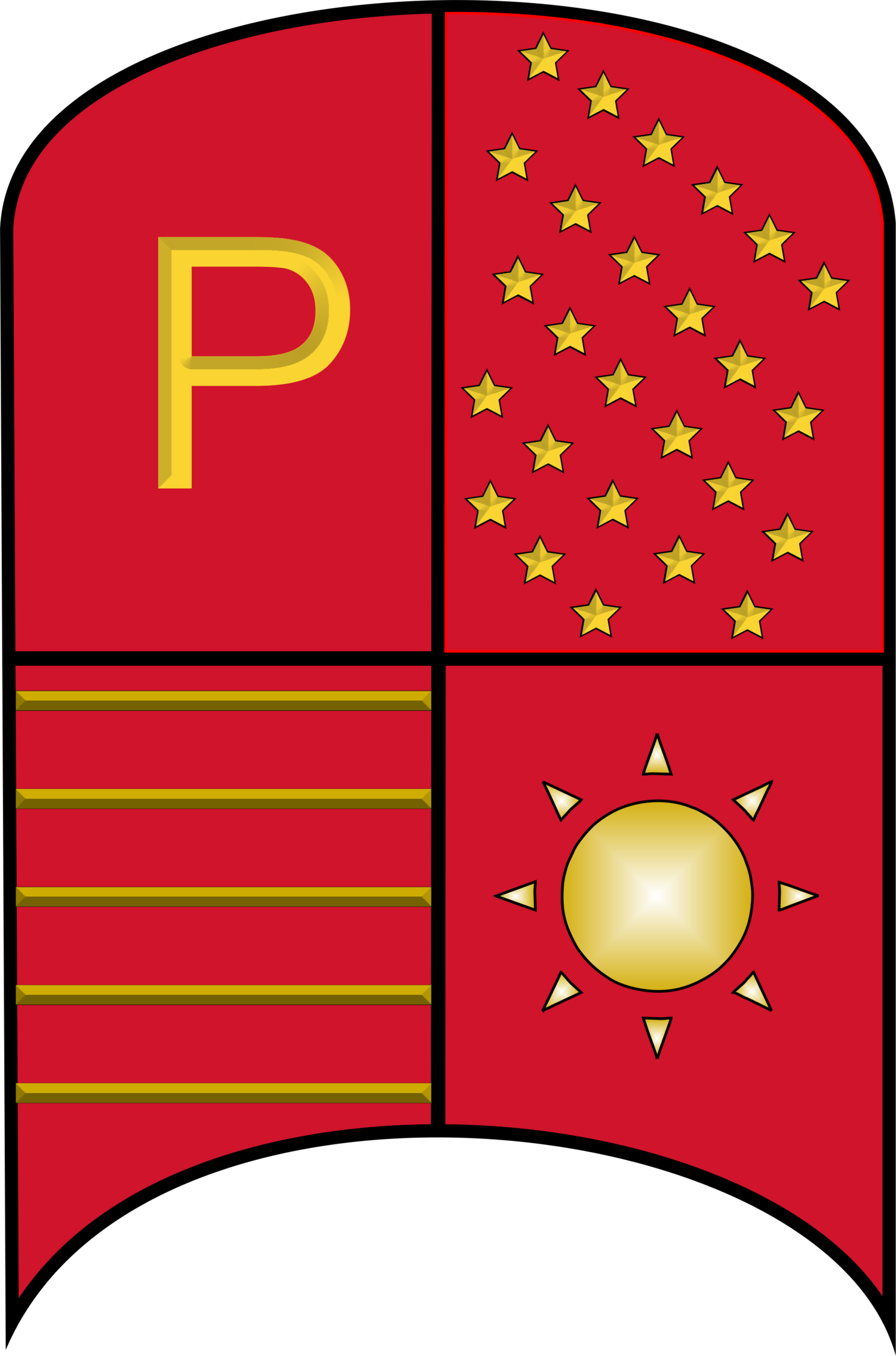

Holding different asset classes creates uncorrelated movement of assets within a portfolio. This uncorrelation is needed in times of volatility. Various asset classes a portfolio can diversify into include Private Equity, Alternative Investments, Hedge Funds, and high-quality direct investments, as well as the asset classes of international stocks, real estate, emerging markets, U.S. Small-Cap Stocks, and U.S. Large-Cap Stocks. A combination of these asset classes can tamp down market volatility. Too, one of the principals of Princeton is a member of the Palm Beach Investment Research Group, which is a bi-weekly forum where many private equity firms, alternative investment managers, and hedge funds tour through, present, are vetted, and critical discussion and evaluation takes place. Too, we are able to see trends as they form and have exposure to a broad array of investment strategies as they are presented and best-thinking in the investment community. These negatively correlated asset classes are beneficial to a portfolio when it comes to protecting against risk.